2024: A dynamic year for PME

PME pension fund has had a dynamic year. In 2024, the fund achieved an annual return of 8.7% and its assets increased by EUR 5.3 billion to EUR 59.9 billion. The fund also supported its social partners by creating a new pension scheme. This resulted in a transition plan, which PME published on its website in the autumn. Meanwhile, PME pushed back the target date for the transition to the new scheme by a year and was unable to fully offset inflation with the 0.3% pension increase. PME ended the year with a funding ratio of 113.1%.

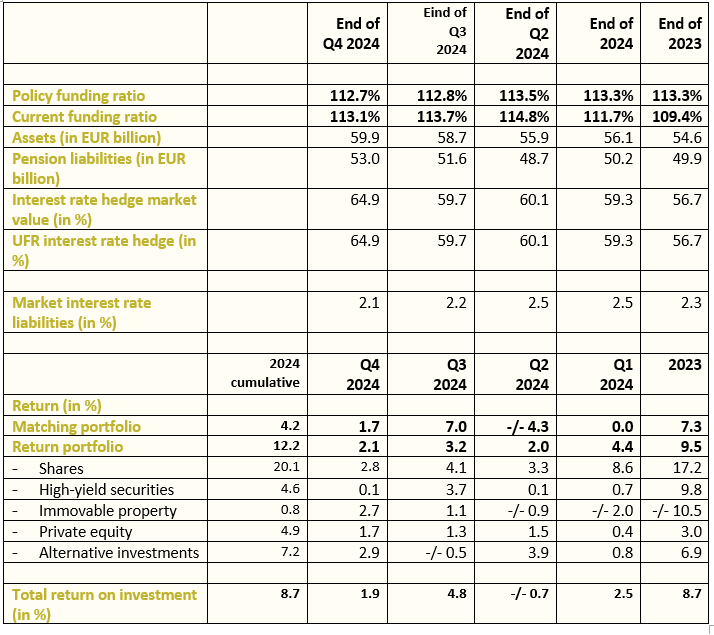

Key figures for Q4 2024

- Current funding ratio as at 31 December 2024: 113.1%

- Policy funding ratio as at 31 December 2024: 112.7%

- Investment return for Q4 2024: +1.9%

- Cumulative investment return for 2024: +8.7%

- Assets up to around EUR 59.9 billion in Q4

- Pension liabilities increased to around EUR 53 billion in Q4

Eric Uijen, Chairman of PME pensioenfonds’ Executive Board:

A look at 2024.

“I have mixed feelings about 2024. It was a year in which incredibly many things happened, both at PME and around the world. I am pleased to see that our social partners have finalised their transition plan. Working with them was a success. At the same time, I feel a personal disappointment that we needed to take the decision to postpone our target date for the transition to the new system by one year to 1 January 2027. I would have preferred otherwise, but transitioning to the new pension scheme with integrity, management and soundness is paramount.

When it comes to our policy decisions, we remain dependent on interest rates and their impact on our funding ratio. Our funding ratio ultimately determines whether and by how much we can increase pensions and how smooth the transition to the new system will be. Of course, that is why PME is trying to protect the funding ratio. But you are never fully in control. This is why PME decided in spring not to take advantage of the relaxed rules surrounding increasing pensions.

Incidentally, PME has already used those relaxed rules three times, increasing pensions by over 11% in total. The generational effects of these earlier increases, combined with a greater likelihood that PME would have to cut more quickly in the face of headwinds, caused us to make a different choice in the spring. As a result of this decision, there will be a small pension increase on 1 January 2025 of 0.3%. Although this will not offset increased prices, we believe it is a balanced decision.

Also given the desire of our social partners for the fund to have enough room to compensate for the average system and to fill a solidarity reserve during the transition to the new system.”

Sustainable investing for a good pension now and in the future.

“Debate arose in 2024 over whether or not pension funds should become ‘activist’ about investment. This was nonsense! At PME, we always approach investment from the point of view of ensuring a good pension for our members. Every investment in our portfolio is there to meet our financial objectives now and in the future. For us, this puts return on one, two and three. As a pension fund, we are responsible for the pensions of all our members, from those who have recently joined us to our oldest retiree who is 106. As a result, we face short-term and very long-term liabilities. Our investment policy also takes into account what the future looks like. Including sustainability considerations in the implementation of investment policy is neither activist nor idealistic. It is realistic and rational.”

Here’s to hoping that 2025 will be a year when stability is restored.

“The war in Ukraine entered its third year in 2024, and the war in Gaza also continued unabated. Donald Trump won the US election for the second time with a promise of America First, a protectionist view of the global economy and a form of isolationism in a world that actually requires leadership and stability. Fortunately, tentative signs of peace in the Middle East are visible. I also hope there will be a just end to the war in Ukraine this year. Ultimately, a stable and peaceful world will also lead to more stable economic results and a better outcome for our members.

Closer to home, there is also reason for some positivity. There are funds that have switched to the new pension rules at an early stage. These stakeholders have seen the benefits immediately. PME and many other funds and their administrators are working very hard to move to the new system next year or the year after. By doing so, we will preserve the best pension system in the world for current and future generations.

A key prerequisite for this to become a reality is legislative and regulatory stability. The ground rules for the transition have been long and widely debated. They were eventually adopted by the Senate of the Netherlands and entered into force on 30 May 2023. Pension providers have been given several years to transition. In the interests of our members and to ensure that execution runs as smoothly as possible, it is important that we do not change the rules of the game during the match. That would be a waste of capital and involve many new costs and uncertainty. The referendum announced by Agnes Joseph (member of the Dutch Parliament from the New Social Contract (NSC) party) knowingly torpedoes precisely that stability and transition to the new system. Her proposal strikes at the foundations of the law, creating legal inequality and instability. This is not a steady government policy. I hold out hope that a sensible decision will be taken on this matter.”