Lower interest rate increases liabilities

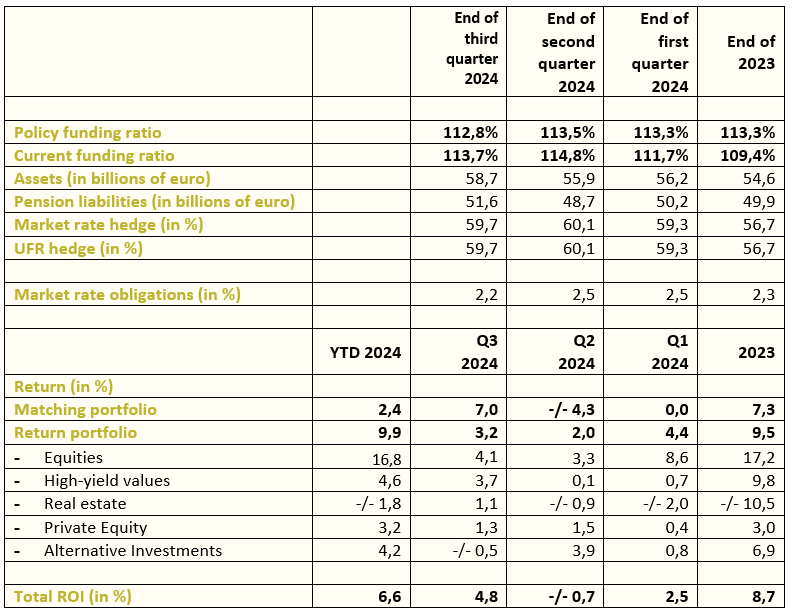

PME's pension liabilities increased in the third quarter of 2024. The current funding ratio fell from 114.8% at the end of June to 113.7% at the end of September. The market interest rate fell from 2.5% to 2.2% in the third quarter. Assets grew by more than €2.8 billion to €58.73 billion.

Key figures third quarter 2024

- Current funding ratio as of September 30, 2024: 113.7%

- Policy funding ratio as of September 30, 2024: 112.8%

- Investment return third quarter 2024: +/+ 4.8%

- Assets in third quarter 2024 increased to approximately €58.7 billion

- Pension liabilities in third quarter 2024 increased to €51.6 billion

Eric Uijen, Chairman of the Executive Board: “Due to the fall in interest rates, our pension liabilities increased. PME has to set aside more money for current and future pensions. This means that, despite a good return and an increase in our assets, the funding ratio has fallen by more than one percentage point this quarter. And in the current system, it is precisely this coverage ratio, not the investment results achieved, that is the primary criterion for funds to determine whether or not they can increase the pensions.

Due to the uncertainty surrounding interest rate developments and the financial markets at the beginning of this year, PME decided in April not to make use of the relaxed regulations in the run-up to the new system. We are convinced that preventing a pensions cut for our participants is more important than an increase. This decision, combined with an unstable world, makes me issue a profit warning. Any possible increase in pensions this year will unfortunately be small.”

Liabilities increase more than assets

PME’s invested assets increased by €2.8 billion in the third quarter of 2024, growing from €55.9 billion to €58.7 billion. The increase is mainly due to good performance on the stock market and high-yield securities. However, the falling interest rate from 2.5% to 2.2% led to an increase in pension liabilities in the third quarter. This caused the funding ratio to decrease from 114.8% at the end of June to 113.7% at the end of September.