Financial position improved again

PME’s financial position improved again in the second quarter of 2024. The current funding ratio rose from 111.7% at the end of March to 114.8% at the end of June, mainly due to a slight increase in the interest rate.

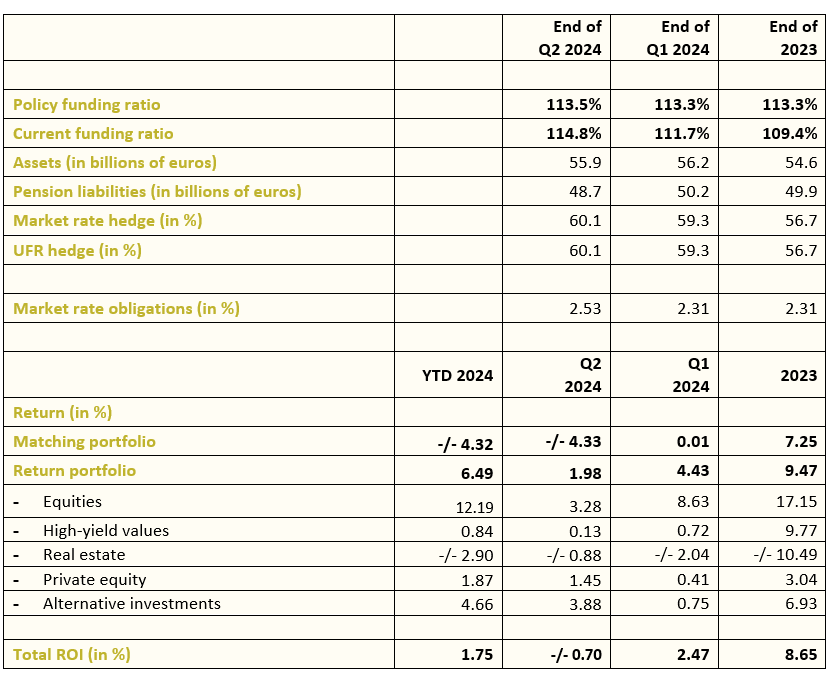

Key figures for Q2 2024

- Current funding ratio as at 30 June 2024: 114.8%

- Policy funding ratio as at 30 June 2024: 113.5%

- Investment return in Q2 2024: -/- 0.70%

- Assets decreased slightly to approx. €55.9 billion in Q2 2024

- Pension liabilities decreased to €48.7 billion in Q2 2024

Eric Uijen, Chairman of the Executive Board: ‘The slightly rising interest rate is causing a negative return on our matching portfolio. However, the rising interest rate also means that we have to set aside less money for current and future pensions. As a result, our financial health has improved again. This is good news for both our contributing and retired participants. After all, a healthy financial position will make it a lot easier to transition smoothly to the new pension scheme as of 1 January 2026. But we still have some way to go. We live in a turbulent world full of conflict. A lot can still happen in a year and a half.’

Liabilities decreased more than assets

PME’s invested assets decreased by €0.3 billion to €55.9 billion in Q2 2024. The slight decrease was caused by the negative return on the matching portfolio. The positive return on the return portfolio was not sufficient to compensate for this. The slightly rising interest rate (from 2.31% to 2.53%) resulted in a decrease in pension liabilities in Q2. On balance, this improved PME’s financial position and put the current funding ratio at 114.8% as at the end of June 2024. At the end of 2023, this was still 109.4%.

Key figures for Q2 2024

Tightening the climate plan

A good pension requires a good return on investment. And investing is better in a world with a liveable climate. After all, extreme heat, floods and crop failures threaten not only the lives of an increasing number of people, but also economic growth worldwide. That is why PME is ramping up its sustainable investments, with objectives that are in line with the Paris Climate Agreement. We are convinced that this will ensure a good pension in the best way possible.

PME published its first climate plan at the end of 2022. It set an important target for 2030: reducing the absolute CO2 emissions of our equity portfolio by half. While we have now comfortably achieved that target, we cannot sit back. Our tightened plan now also includes climate ambitions for our investments in government bonds, mortgages and forestry. In the run-up to the next version, we will assess our achievements and where we can take things to the next level.

Eric Uijen, Chairman of the Executive Board: ‘Our equity investments are ahead of schedule. We are proud of that. But we still have some way to go. We are looking closely at what we are already doing and what else can be done. Our participants and employers expect as much from us. After all, a cleaner and more stable world increases the chance of a good pension for retired participants as well as future generations.’

If you want to know more about our tightened climate plan, visit pmepensioen.nl/en/investments/climate-plans.