PME's financial position still improving

PME ends the year 2021 with a funding ratio of 107.9%. The improvement in our financial position continues. Across the year, the funding ratio increased by over 10%: the year 2020 ended with a funding ratio of 97.6%. Invested capital rose from €61.6 billion to €64.0 billion in 2021. PME had a total return of 3.5% in 2021. Pension commitments decreased from €63.1 billion to €59.3 billion in 2021.

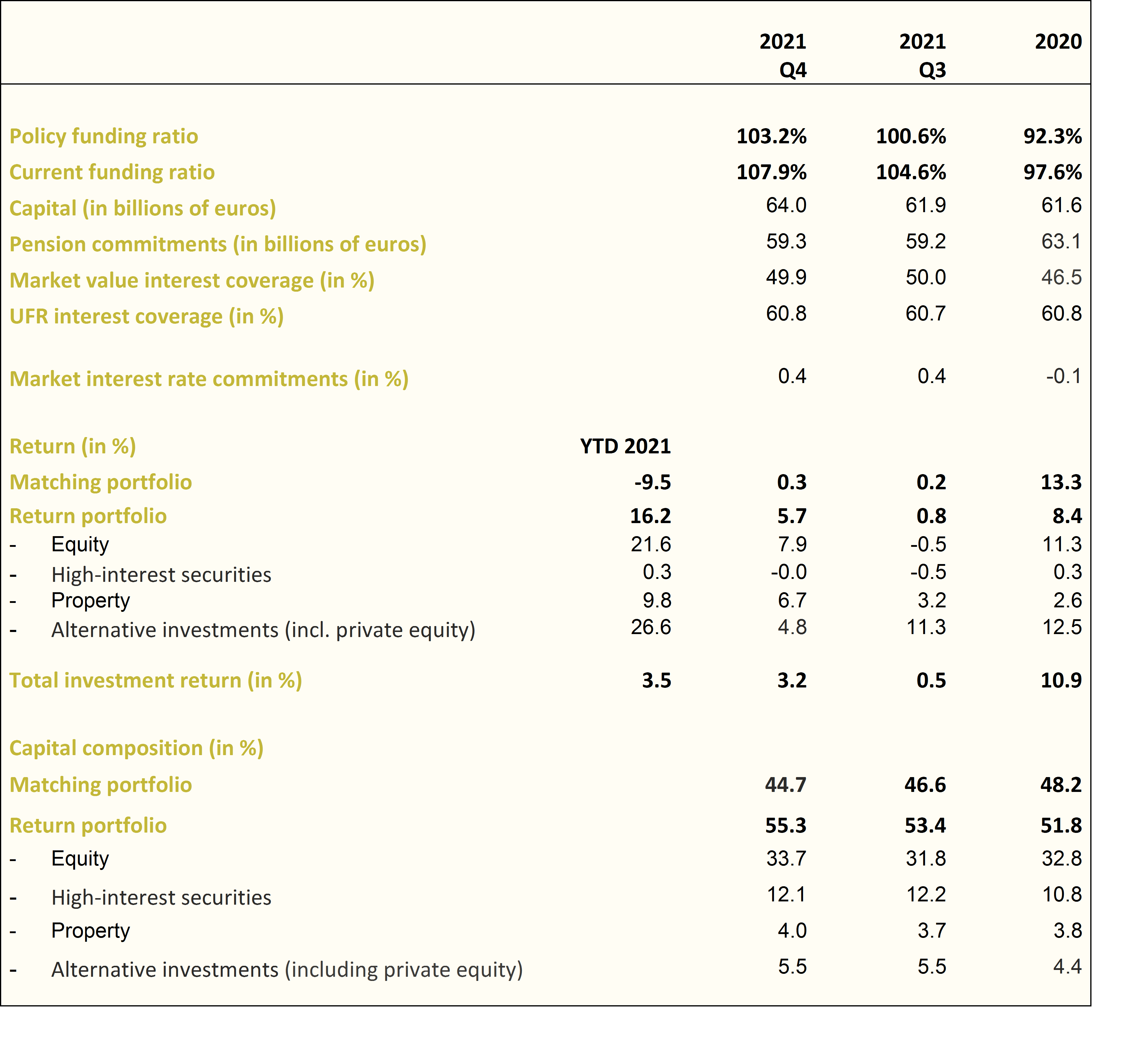

Key figures Q4 2021

- Current funding ratio as at 31 December 2021: 107.9%

- Policy funding ratio as at 31 December 2021: 103.2%

- Investment return 2021: 3.5%

- Investment return Q4 2021: 3.2%

- Capital increased to approx. €64.0 billion in Q4

- Pension commitments increased to approx. €59.3 billion in Q4

Eric Uijen, chairman of the executive board: "Our financial situation improved in 2021. The increase was stable in the fourth quarter as well. This resulted in a funding ratio of 107.9% at the end of 2021. It was the positive return on investments in shares, property and alternative investments that caused this increase in funding ratio in the fourth quarter. We are doing better financially than in recent years, when we faced the threat of a decrease in pensions."

Pensioners disappointed

Because of relaxation of the rules, PME did not have to reduce pensions in recent years. At the same time, PME pensions have not been increased for many years, either. Inflation has risen sharply in recent months. Also, uncertainty has arisen among pensioners about the annual increase in state retirement pension. The government intends to stop linking the increase in state retirement pension to the rise in minimum wage, causing a great deal of discussion. "For our pensioners, state retirement pension makes up the largest part of their monthly income, which is supplemented with a pension payment from PME. We understand pensioners' disappointment and the increasing call for indexation," says Uijen.

Relaxation of the rules for pension increase

In the new pension system, the amount of pensions no longer depends on the funding ratio. Pension funds also have to maintain fewer buffers. At the moment, pension funds may only apply indexation when the policy funding ratio is 110%. The government intends to relax these rules. This means that, in the run-up to the new pension system, pension funds can already apply indexation at a policy funding ratio of 105%. PME's policy funding ratio was 103.2% at the end of 2021.

Eric Uijen: "We support the government's proposal to relax the rules as we move toward a new pension system. It will allow us to decide at an earlier stage whether or not we will increase the pensions. But truth be told, we have to consider more than just the funding ratio at a certain point in time. We must also take other elements into account. Such as the time of transfer to the new pension system, how all pensions will be converted to the new system, maintaining the required reserves, and potential compensatory measures. In the coming period, we will intensify discussions with social partners and determine our course as we move towards the new pension system. If the financial markets remain favourable to us in the coming months, we will take stock again in the foreseeable future. We can then make well-informed decisions about increasing pensions in the near future."

Value transfers restarted in Q4

People who change jobs and start to accrue pension with a new fund often want to transfer their pension to the pension fund of their new employer. Value transfer is possible if both funds involved have a policy funding ratio of at least 100%. Value transfers at PME restarted in Q4.

Capital and commitments increased in Q4

PME's total capital rose from €61.9 billion to €64.0 billion in Q4 2021. This increase is mainly the result of positive returns on investment in shares, property and alternative investments. The value of the commitments rose from €59.2 billion to €59.3 billion.

Key figures Q4 2021